Ideally, you'll want to at the very least hold out about six months before you decide to apply for an car financial loan. That offers you time and energy to repair your credit history and rebuild credit rating, too. You make payments on any loans you've left to make a favourable credit score historical past.

Many backlinks outlined on this together with other internet pages are preserved by other private and non-private companies. These back links and ideas are supplied to the person's convenience. The U. S. Bankruptcy Courtroom isn't going to Handle or guarantee the accuracy, relevance, timeliness, or completeness of this outside facts.

Need to I buy a automobile ahead of or after bankruptcy? This actually is determined by your economical situation and needs. Taking over debt just before you decide to file for bankruptcy is usually not excellent. The courts will evaluate debts taken on just prior to deciding to file to check out should you’re endeavoring to dedicate bankruptcy fraud.

Failure to comply with the filing needs, or missing deadlines, could end in the dismissal of the case, as well as the lack of bankruptcy safety

Am i able to get an FHA mortgage after Chapter seven? Yes, presented you rebuild your credit score and wait two a long time after your bankruptcy is permitted by the courts. Staying away from new financial debt after your bankruptcy is discharged might also help your likelihood of qualifying for an FHA property finance loan.

EasyAutoLenders.com is usually a direct service provider to lenders throughout the US. Typical APR costs range from 3.2% to 24% site here according to credit rating. Some dealers/lenders can have implications for non-payment or late payments, please see your distinct terms For more info.

From there, they will prepare the mandatory documentation, signify you prior to weblink the courtroom and communicate with creditors right until your bankruptcy is accomplished and you have regained financial safety.

Most financial specialists concur that filing for bankruptcy ought to only be finished as A final resort. As an example, you might be needed to sell quite a few of the property to repay your creditors. You'll have a large strike with your credit history rating, plus your bankruptcy will stick to you for view it approximately 10 years - rendering it difficult to obtain a dwelling, a vehicle, or perhaps a work.

FHA loans: Any event that lessened your family earnings by 20% or even more for at least 6 months is taken into account an eligible circumstance by the FHA

“Obtaining a personal loan will be very difficult for just a few years promptly subsequent a bankruptcy,” says Reggie Graham, department supervisor for Silverton Property finance loan.

If you have a tough time qualifying for Chapter 7 bankruptcy with no motor vehicle possession deduction, funding a fresh car or truck prior to filing your scenario can raise a red flag. At your meeting of creditors, the trustee will typically question you thorough YOURURL.com questions on why you bought the vehicle.

Am i able to buy a car while in Chapter 13 bankruptcy or Chapter site seven bankruptcy? It’s not likely you should manage to buy a vehicle through Chapter seven bankruptcy. Such a filing features a much shorter timeline that you could full in as little as 6 months. Your credit score is frozen any time you file for bankruptcy by having an computerized keep.

This involves signing a brand new contract That usually has a similar conditions as your prior vehicle personal loan, and it makes sure the car won't be repossessed so long as you keep paying out in time.

If you'll want to rebuild your credit history after bankruptcy, this is the solid possibility. Generating on-time payments can enhance your credit score rating, assisting you to definitely qualify for future loans.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Judge Reinhold Then & Now!

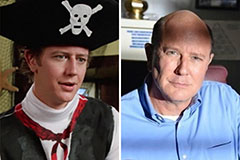

Judge Reinhold Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!